child tax credit portal not working

Another reason could be that the IRS is missing information it needs to process your child tax credit. Max refund is guaranteed and 100 accurate.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021.

. These people can now use the online tool to register for monthly child tax credit payments. The IRS has partnered with the third-party company to verify identities before allowing access to the portals. Posted by 2 months ago.

Be your son daughter stepchild eligible foster child brother sister. You can also use the portal to unenroll from receiving the monthly payments if you are not eligible or prefer to receive the full amount of your credit when you file. After that there is a refundable portion called the Additional Child Tax Credit that is calculated based on the amount of income you earned.

To be a qualifying child for the 2021 tax year your dependent generally must. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Free means free and IRS e-file is included.

The new bill known as the American Rescue Plan includes the following changes to this tax credit for tax year 2021. The Child Tax Credit helps all families succeed. Be under age 18 at the end of the year.

Child Tax Credit portal not working. The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a. The credit is increased to 3600 for children less than 6 years old.

It increases the credit amount. I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying. You do not necessarily get the maximum amount.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. It increases the credit amount from 2000 to 3000 for children 6- 17. The Child Tax Credit Update Portal now issues a warning in bold.

Do not assume your refund will include 2000 per child for child tax credits. 2021 Child Tax Credit and Advance Payments. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a bank account to receive your payments quickly by direct deposit. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. You get 15 of the.

The CTC is used first to reduce your tax liability to zero. The Child Tax Credit Update Portal allows you to. I cant even get into the.

Making a new claim for Child Tax Credit. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

And towards the end of this post we will walk through step-by-step what you need in order to. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. Get help dealing with the IRS on a variety of tax problems including back taxes tax notices property liens and levies.

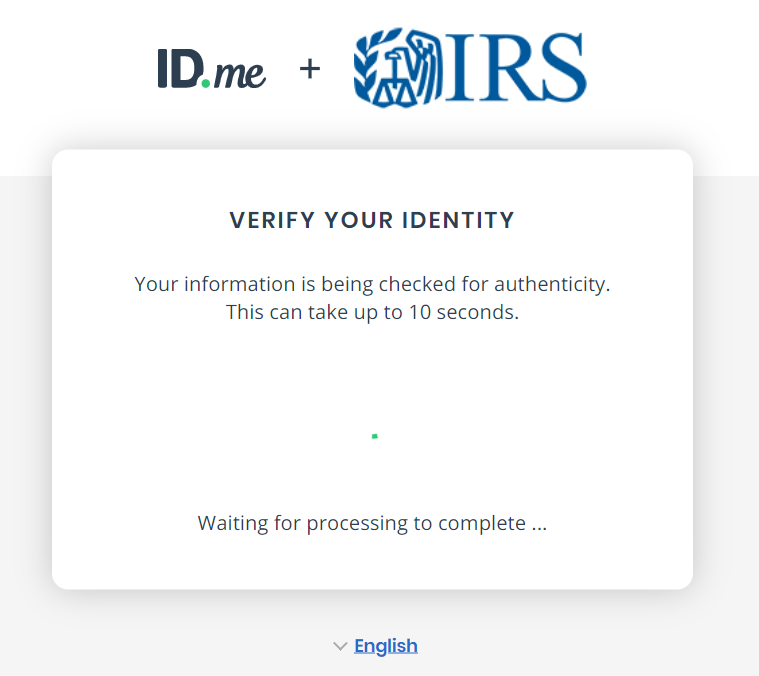

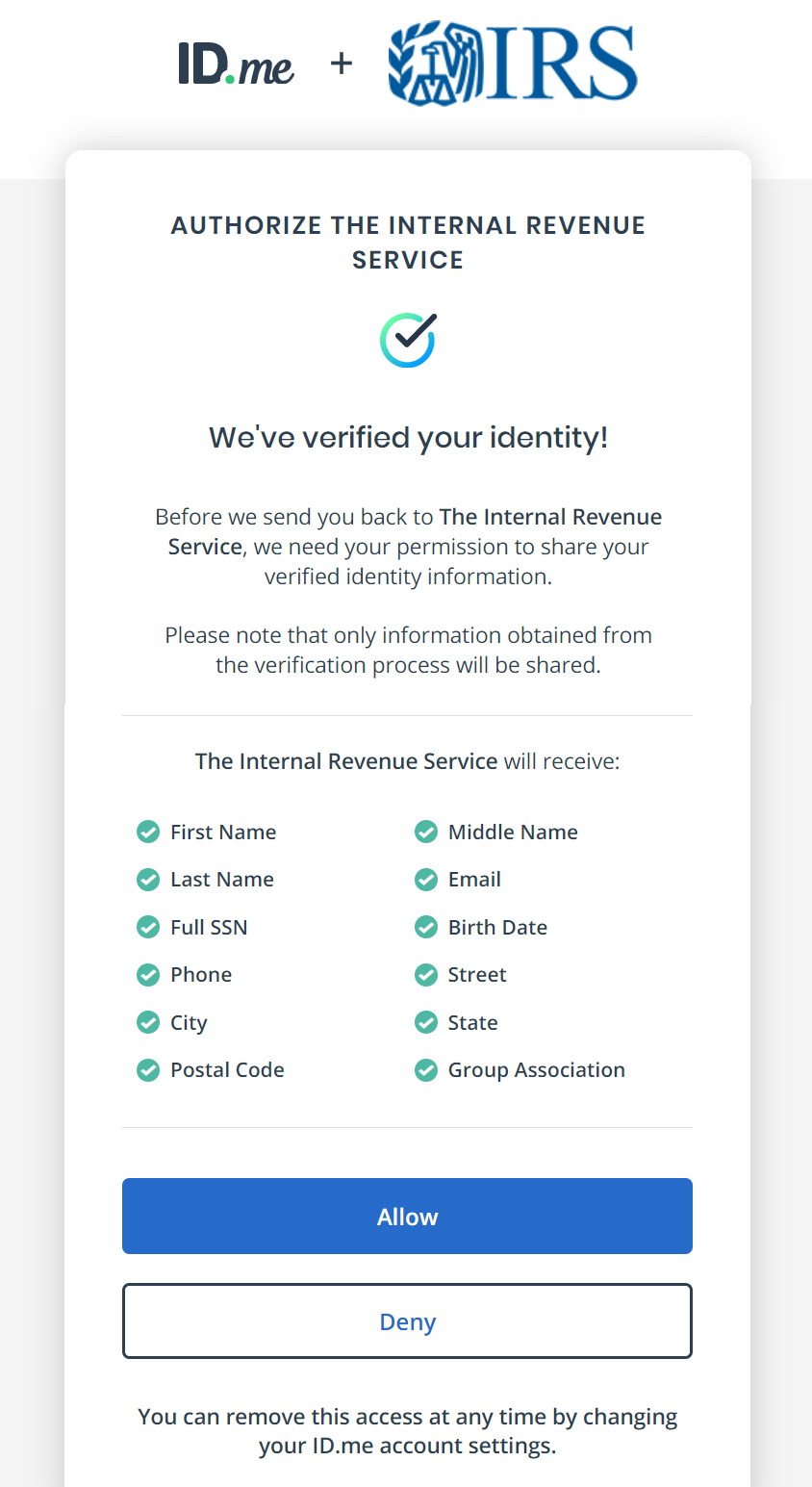

In order to sign in to any of the portals you will need to first verify your identity through IDme. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The Child Tax Credit provides money to support American families helping them make ends meet.

Child Tax Credit portal not working. To opt out of the upcoming July 15 payment families need to use the portal to unenroll by June 28 2021. I qualified for all 3 stimulus checks and all 3 came via direct deposit I checked my bank Chase to see if I the CTC was.

10 votes 64 comments. If the information is incorrect. It does not work that way.

The Child Tax Credit Update Portal is no longer available. Double-check that your bank account information is correct. The Child Tax Credit Update Portal now issues a warning in bold.

Childctc The Child Tax Credit The White House

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Code For America Launches Free Mobile Friendly Getctc Portal Available In English And Spanish Code For America

Beware Of Canada Revenue Agency Cra Scam Emails Text Messages Or Online Forms 2022 Turbotax Canada Tips

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

Missing A Child Tax Credit Payment Here S How To Track It Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

The Advance Child Tax Credit What Lies Ahead

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back